- Casino News

- Industry News

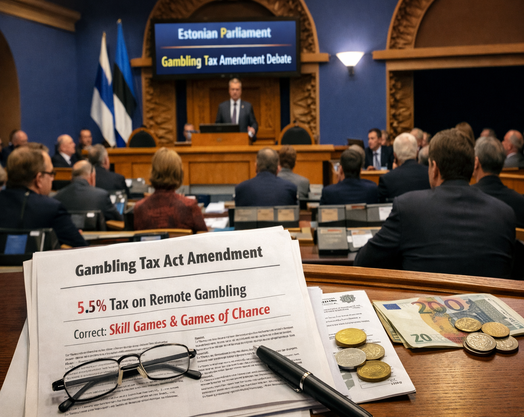

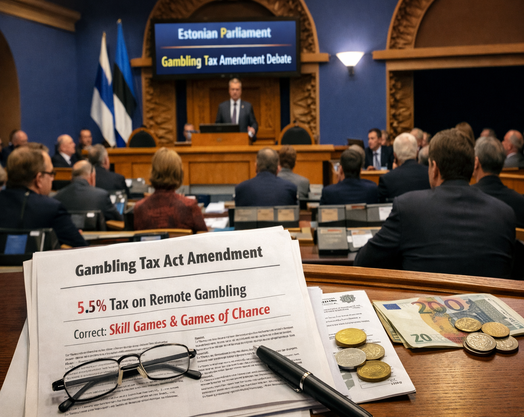

Estonia Revisits Gambling Tax Law After Drafting Slip

Estonia Revisits Gambling Tax Law After Drafting Slip

A technical error in legislative wording has prompted Estonia's parliament to revisit its Gambling Tax Act, after an unintended omission left online casino operations outside the scope of this year's revised tax rate. Lawmakers are now preparing to correct the text and restore the originally intended 5.5 per cent levy on remote gambling, with the amendment scheduled to take effect on March 1, 2026.

The situation emerged from changes adopted late last year as part of a broader plan to reduce gambling tax gradually. Estonia had set out a multi-year adjustment, lowering the rate from 6 per cent to 4 per cent by 2028, cutting it by half a percentage point each year. For 2026, the rate was meant to stand at 5.5 per cent.

The omission was not identified immediately. It was only after the law entered into force that the discrepancy became clear. By excluding games of chance from the applicable clause, the text effectively removed the legal basis for taxing online casino operations at the intended rate.

The discovery created an unusual situation. Operators remained subject to regulatory oversight, yet the statutory basis for collecting the revised tax on online casino activity remained unclear. Industry representatives indicated a willingness to continue paying in line with the policy's original intent. Companies such as Yolo Group, along with the national gambling operators' association, signaled that maintaining contributions would support stability.

Member of Parliament Tanel Tein introduced an amendment designed to resolve the issue. He acknowledged that the discrepancy stemmed from drafting rather than policy change and emphasized the need for a prompt correction. The proposal reinstates “games of chance” within the relevant clause, thereby restoring the intended scope of the 5.5 per cent rate for remote gambling.

Remote gambling forms a meaningful part of Estonia's regulated betting market. The 5.5 per cent levy on remote gambling is forecast to generate approximately €27 million in 2026. While operators expressed readiness to comply with the intended rate, the absence of clear wording raised concerns about how such payments would be treated under public finance rules.

Estonia's phased reduction of gambling tax has been positioned as a long-term measure aimed at balancing competitiveness with fiscal responsibility. The annual half-percentage-point decrease was structured to provide predictability for licensed operators while maintaining public revenue. Ensuring that legislative language reflects that structure is central to its implementation.

The amendment does not alter the broader policy trajectory. It restores the alignment between stated intent and statutory wording. Future-year provisions remain unchanged, and the schedule for gradual reduction toward 4 per cent by 2028 continues as planned.

Top Online Casinos

10 Recommended MGA Online Brands On CasinoLandia That Will Enhance Your Gaming Experience

No results were found!